top of page

Tips, Tools & Tax Chat

From tax tips to time-saving tools, business advice to bookkeeping basics—we share the stuff every small business owner should know (without the jargon). Whether you’re here to learn, stay up to date, or just feel a bit more in control, you’re in the right place.

Search

Why “Quick Questions” Aren’t Always Quick (and Why We Sometimes Charge)

So if you’re ever unsure, ask an accountant. And if it turns out to be quick, great. If it needs more work, we’ll tell you upfront and help you decide the best next step.

That’s how we keep things clear, fair and working properly for everyone.

Jan 28

Protect Your Business and Personal Assets

Learn how to manage overdrawn shareholder current accounts, understand the shareholder loan tax implications NZ, navigate IRD shareholder loan rules, and protect your business and personal assets in the event of company liquidation.

Jun 26, 2025

Rebates, Gift Cards, and Tax: A Simple Guide for Small Business Owners

Learn about the tax implications of gift cards and rebates for small businesses. Get the facts on rebate taxes and gift card taxes, and how they affect your business’s tax obligations.

Jun 5, 2025

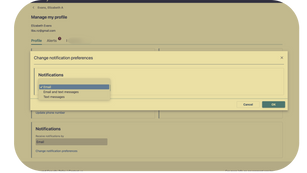

How to Set Up MyIR Notifications and Stay on Top of MyIR Letters

Learn how to set up myIR notifications to ensure you never miss important myIR letters. Stay updated on tax reminders, requests for informat

Mar 3, 2025

Streamline Your Expense Tracking with TaxSnaps

Ditch the shoebox of receipts! Streamline your expenses tracking with TaxSnaps—an IRD-approved app for self-employed pros and small businesses. Snap, store, and share receipts with ease, and enjoy secure cloud storage, easy reporting, and exclusive My Two Cents discounts.

Nov 14, 2024

Work-Related Meal Deductions: Explained! (Includes Examples)

Confused about work-related meal deductions in New Zealand? Learn what meals are deductible, including business travel, employee expenses, and client entertainment. Real examples explained.

Sep 23, 2024

Should you buy or lease your business assets?

Wondering whether to buy or lease business assets? Learn the pros and cons of leasing vs buying equipment, vehicles, or machinery, and how each option impacts your business finances and tax position.

Jun 1, 2024

Claiming Motor Vehicle Expenses - the need to knows!

Learn how to claim motor vehicle expenses for business use in NZ. Discover IRD-approved methods like log books, kilometre rates, and actual cost claims to stay compliant and maximise your deductions.

May 24, 2024

GST changes for short term accommodation and online services

New GST rules apply from 1 April 2024 for Airbnb, short term accommodation, ride share, and food delivery platforms. Here is what hosts and small business owners need to know, including how Marketplace operators will collect and return GST.

Mar 24, 2024

bottom of page